Here is the summary of the yet another CMHC new rule for “high ratio” mortgages (20% < lower down payment). Note – this change of rule does NOT apply to anyone who has 20% down payment or more.

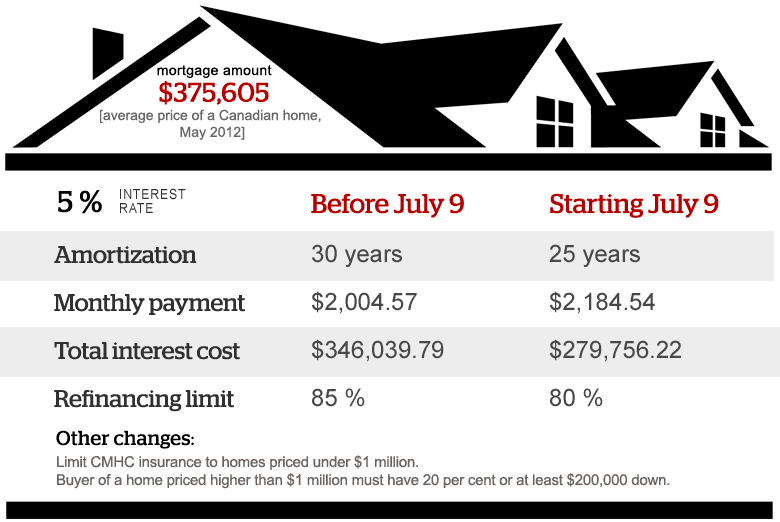

- Reduce the maximum amortization period to 25 years from 30 years. This will reduce the total interest payments Canadian families make on their mortgages, helping them build up equity in their homes more quickly and pay off their mortgages sooner. The maximum amortization period was set at 35 years in 2008 and further reduced to 30 years in 2011.

- Lower the maximum amount Canadians can borrow when refinancing to 80 per cent from 85 per cent of the value of their homes. This will promote saving through home ownership and encourage homeowners to prudently manage borrowings against their homes.

- Fix the maximum gross debt service ratio at 39 per cent and the maximum total debt service ratio at 44 per cent. This will better protect Canadian households that may be vulnerable to economic shocks or an increase in interest rates.

- Limit the availability of government-backed insured mortgages to homes with a purchase price of less than $1 million.

Summary courtesy of by Best Rate Best Mortgage

And if you are a visual person, this infographic may help to put things in perspective…

For the in-depth detail of the rule, see CMHC FAQ.

Author

Categories

Tags

affordable home

aménagement

attached garage

bureau

Cabana

cellier

colors

Customer Service

decor

decor

Decoration dhp

decorations

design

DIY decor

DIY PROJECTS

déco

Finance and legal dhp

fireplace

foyer

Home Addition and Remodeling dhp

Home Construction

home renovation

house plan

House plans

House plans

idées

Kitchen design

lakefront home

lakefront house plan

lakefront house plans

Latest Trends dhp

laundry

Luminaire

moderne rustique

Multigenerational

narrow lot

New Home Benefits

organization

Popular House Plans

renovation design services

split level

Terrace

top quality house plans

trend

truc et astuce